42 federal unemployment tax zhongwen

State Unemployment Tax Act dumping is a practice used to circumvent paying unemployment insurance taxes involving manipulation of the state experience rating systems to achieve a lower tax rate. SUTA Dumping. Workplace Posters. Employers determined to be liable under the Employment Security Law (Chapter 96 of the North Carolina General Statutes ... federal unemployment tax Chinese translation:联邦失业保险税federaladj. 1.同盟的,联合的。 .... click for more detailed Chinese translation, definition, ...

File Wage Reports & Pay Your Unemployment Taxes Online. Use our free online service to file wage reports, pay unemployment taxes, view your unemployment tax account information (e.g., statement of account, chargeback details, tax rate), and adjust previously filed wage reports. File wage reports, pay taxes & more at Unemployment Tax Services.

Federal unemployment tax zhongwen

Create a user account for your unemployment benefits. File your weekly claim (Sun - Fri only) Check status of weekly claim or manage your account. Select a benefits payment option. Get tax info (1099G form) File your application for Extended Benefits (EB) Received an extended benefits letter. File for Pandemic Unemployment Assistance (PUA) federal unemployment tax in Chinese : 联邦失业保险税…. click for more detailed Chinese translation, meaning, pronunciation and example sentences. DUA oversees the unemployment insurance (UI) program, which provides temporary income assistance to eligible workers in Massachusetts. DUA also determines and collects employer contributions to the UI program. To report fraud or get help with your claim, call Unemployment Customer Assistance at (877) 626-6800.

Federal unemployment tax zhongwen. Unemployment benefits are taxable income reportable to the Internal Revenue Service (IRS) under federal law. You must report all unemployment benefits you receive to the IRS on your federal tax return. If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. For example, Texas will not release 2021 information until June due to COVID-19. We will update this information as the states do. State. SUI New Employer Tax Rate. Employer Tax Rate Range (2021) Alabama. 2.7%. 0.65% - 6.8% (including employment security assessment of 0.06%) Alaska. (Right click on link, go down to "Save Target As" and save it to your computer). There are several questions on the form regarding the qualifications of General Employers, Agricultural Employers, Household Employers, Nonprofit Employers, acquiring an existing business or if you are already subject to the Federal Unemployment Tax Act (FUTA). When calculating taxable employment income for non-residents, IIT law only allows the standard basic deduction of CNY 5,000 per month. Capital Tax Rate: A fixed ...Corporate Taxes · Accounting Rules

Kentucky's Unemployment Insurance Self-Service Web. Submit quarterly tax reports over the Internet through either an on-screen form or a file upload option. Contributory Employers - Reserve accounts of contributory employers will continue to be relieved of benefit charges through the 1 st, 2 nd, and 3 rd quarters 2021. (Updated:10/04/2021) Robert A.J. McDonald · 2021 · Political ScienceTaxes were still a focus, but concern about Chinese unemployment ... a federal royal commission, and the implementation of Canada's head tax in 1885 ... Call Center (all claims): (833) 901-2272 or (808) 762-5751 and (833) 901-2275 or (808) 762-5752. DLIR Launches New Website. The Department of Labor & Industrial Relations has launched a new website to provide answers to frequently asked questions, to share information alerts and to provide other resources related to Hawaii unemployment. Unemployment benefits provide you with temporary income when you lose your job through no fault of your own. The money partly replaces your lost earnings and helps you pay expenses while looking for new work. The benefits, from taxes your former employer (s) paid, are not based on financial need. While you receive benefits, your job is to get ...

Create new account. SecureAccess Washington allows Internet access to multiple government services using a single username and password. Example: you may have created a SAW account to pay your LNI premium or unemployment insurance taxes. Once you're signed in, you can change your password and access various government services. 2022 Base Unemployment Insurance Tax Rate for Employers N.C. Senate Bill 311, signed into law by Governor Roy Cooper on Nov. 10, freezes the base contribution rate to the state's Unemployment Insurance Trust Fund for experience-rated employers at 1.9% for 2022. Learn how to clear your browser cache if you experience issues logging in with your NY.gov username and password. You can also certify for weekly benefits with our automated phone system by calling 833-324-0366 (for PUA) or 888-581-5812 (for UI). Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FUTA tax.

Jan 27, 2021 — For more information on qualifying for the federal credit, ... Get all the credit you deserve with Earned Income Tax Credits.

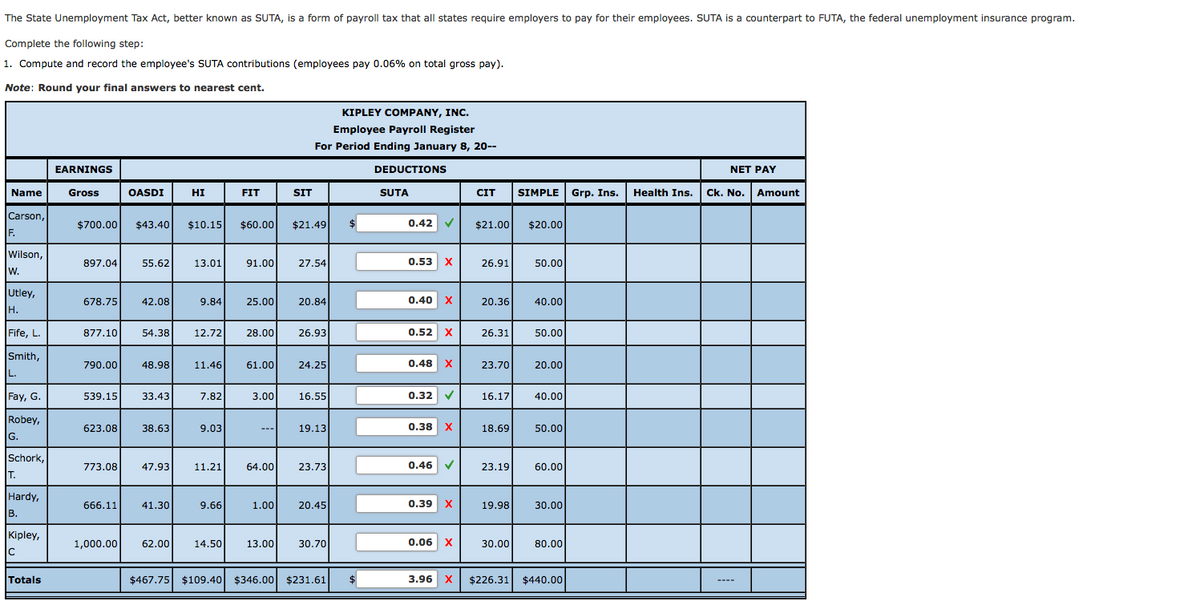

Payroll Taxes Deposits And Reports Section 2 Unemployment Tax And Workers Compensation Chapter 11 Section Objectives 6 Compute And Record Ppt Download

The Australian federal government (ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as ...

The CARES Act and other federal programs that expanded and extended unemployment benefits expired the week ending Sept. 4, 2021. Visit the COVID-19 info page to learn more. Need other support to cope during COVID-19? You might be eligible for Paid Leave. Learn about other resources that may be available to you at Washington state's COVID-19 ...

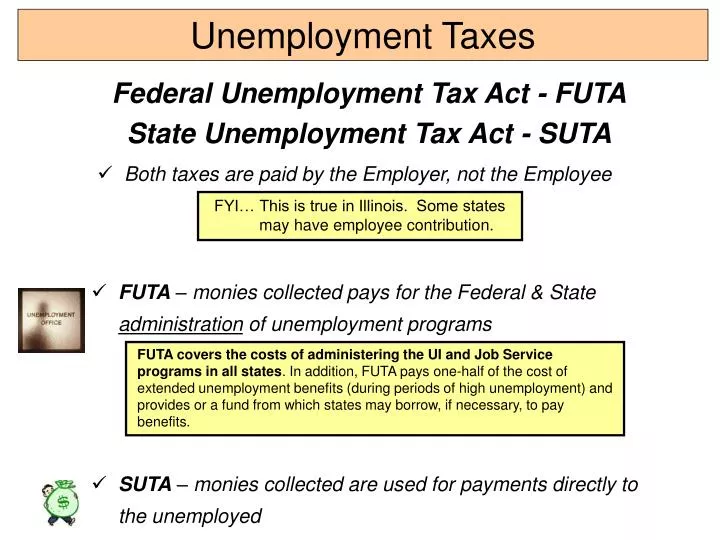

The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax.

Making India S Social Protection Shock Responsive Lessons From Pds Amid Covid 19 Socialprotection Org

Contact your state's unemployment insurance program for the most up-to-date information. The American Rescue Plan Act of 2021 temporarily authorized: An extension for people already receiving unemployment benefits. Automatic, additional payments of $300 per week to everyone qualified for unemployment benefits.

Today, employers must pay federal unemployment tax on 6% of each employee's eligible wages, up to $7,000 per employee. Usually, your business receives a tax credit of up to 5.4% from the federal...

Form 1023121704/21/2021Application for Recognition of Exemption Under SecForm 1023‑EZ061407/01/2014Streamlined Application for Recognition of ExemptiForm 1024011811/27/2019Application for Recognition of Exemption Under SecForm 1024‑A011808/17/2021Application for Recognition of Exemption Under SecView 1018 more rows

Chinese In Eastern Europe And Russia A Middleman Minority In A Transnational Era Chinese Worlds Pdf Manchuria Qing Dynasty

The State of New York does not imply approval of the listed destinations, warrant the accuracy of any information set out in those destinations, or endorse any opinions expressed therein. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites.

Unemployment Information for Businesses. The Unemployment Insurance program, jointly administered by the state of New Mexico and the federal government, pays benefits to people who are out of work through no fault of their own and who meet certain qualifications. These benefits are financed through employers' payroll tax contributions.

The Federal Unemployment Tax Act (FUTA) is legislation that imposes a payroll tax on any business with employees; the revenue raised is used to fund unemployment benefits. As of 2021, the FUTA tax ...

Unemployment Insurance has been in existence since 1939. The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own. The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust fund.

Notice for Pandemic Unemployment Insurance Claimants. Effective July 27th, 2021, you will no longer be able to file a new PUA claim through this portal. Claimants needing PUA assistance must contact the PUA call center at (406) 444-3382 between the hours of 8:30 a.m. . . . Self Employed, Contractors, and other individuals may qualify for ...

Apter Vocabulary Salaries Expense Federal Unemployment Tax Act Futa State Unemployment Tax Act Suta Tax Act Meme On Me Me

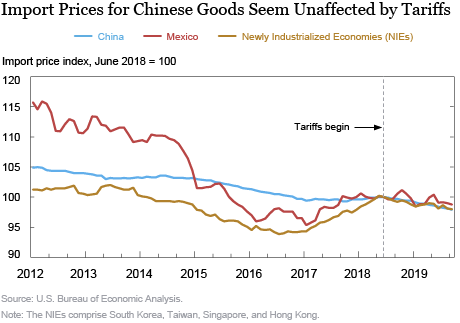

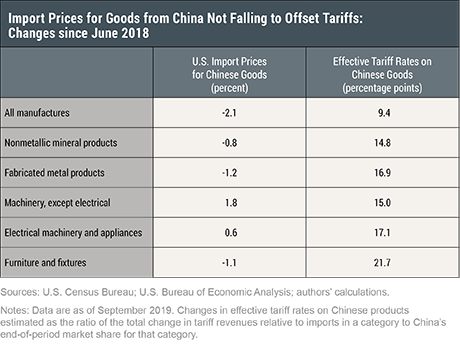

We estimate that retaining the tariffs put in place under the Trump administration would reduce economic output, income, and employment.

Suspect Fraud? Report it by calling toll-free. 1-800-686-1555 or click: Report Fraud

Federal Unemployment Tax Act Look It Up The Images Really Help To Understand What It Is All The Information In One Image

Unemployment Tax Rates The Unemployment Tax Rates in Wyoming are assigned per W.S. 27-3 Article 5. Employers with at least three years of "experience" on their account will be assigned a base rate calculated on their specific benefit ratio.

The Department registers employers, collects the tax and wage reports due, assigns tax rates, and audits employers. Every state has an Unemployment Compensation Program. In 2012, legislation passed in Florida changed the name of Florida's Unemployment Compensation Law to the Reemployment Assistance Program Law.

The Federal Unemployment Tax Act (FUTA) is a federal law that requires businesses to pay annually or quarterly to fund unemployment benefits for employees who lose their jobs. The FUTA tax rate is 6% of the first $7,000 of wages, though many businesses qualify for a tax credit that lowers it to 0.6%. Most businesses also have to comply with ...

Payroll Taxes Deposits And Reports Section 2 Unemployment Tax And Workers Compensation Chapter 11 Section Objectives 6 Compute And Record Ppt Download

Federal Pandemic Unemployment Compensation (FPUC) is an emergency program designed to increase unemployment benefits for millions of Americans affected by the 2020 novel coronavirus pandemic. FPUC ...

Pdf Hakka Chinese Political Leadership In East And Southeast Asia And South America L Larry Liu Academia Edu

Publ 3Armed Forces' Tax Guide202002/11/2021Publ 17Your Federal Income Tax (For Individuals)202002/11/2021Publ 17 (KO)Your Federal Income Tax (Korean version)202002/10/2021Publ 17 (RU)Your Federal Income Tax (Russian version)202003/11/2021View 196 more rows

You must pay federal unemployment tax based on employee wages or salaries. The FUTA tax is 6% (0.060) on the first $7,000 of income for each employee. Most employers receive a maximum credit of up to 5.4% (0.054) against this FUTA tax for allowable state unemployment tax. Consequently, the effective rate works out to 0.6% (0.006). 3

DUA oversees the unemployment insurance (UI) program, which provides temporary income assistance to eligible workers in Massachusetts. DUA also determines and collects employer contributions to the UI program. To report fraud or get help with your claim, call Unemployment Customer Assistance at (877) 626-6800.

federal unemployment tax in Chinese : 联邦失业保险税…. click for more detailed Chinese translation, meaning, pronunciation and example sentences.

Create a user account for your unemployment benefits. File your weekly claim (Sun - Fri only) Check status of weekly claim or manage your account. Select a benefits payment option. Get tax info (1099G form) File your application for Extended Benefits (EB) Received an extended benefits letter. File for Pandemic Unemployment Assistance (PUA)

Payroll Taxes Deposits And Reports Section 2 Unemployment Tax And Workers Compensation Chapter 11 Section Objectives 6 Compute And Record Ppt Download

0 Response to "42 federal unemployment tax zhongwen"

Post a Comment